Step 5: Follow the instructions on screen and finish the installation.(If your machine is with higher security settings, it may not allow you to install the printer driver from internet.) Step 3: Save the installation package to your local folder first.Step 2: Click the download link or the blue "DOWNLOAD NOW" button.Step 1: Log in Administrator of your local machine.Please feel free to contact us if you need any help.ĭepending on machine settings, some user may need to restart computer after installation. You can also download this W-2C software from Ĥ. If you machine has higher security settings, you may need to save this installation package to the local machine first.

You need to login as administrator of local machine.Ģ. This software is compatible with Windows 11.ġ.

This software can run on both 32-bit or 64-bit computer. net framework 3.5 from Microsoft site to solve this issue. net framework is disabled on your computer or is not installed, you may see such message ".net framework version x.x is required." You can enable.

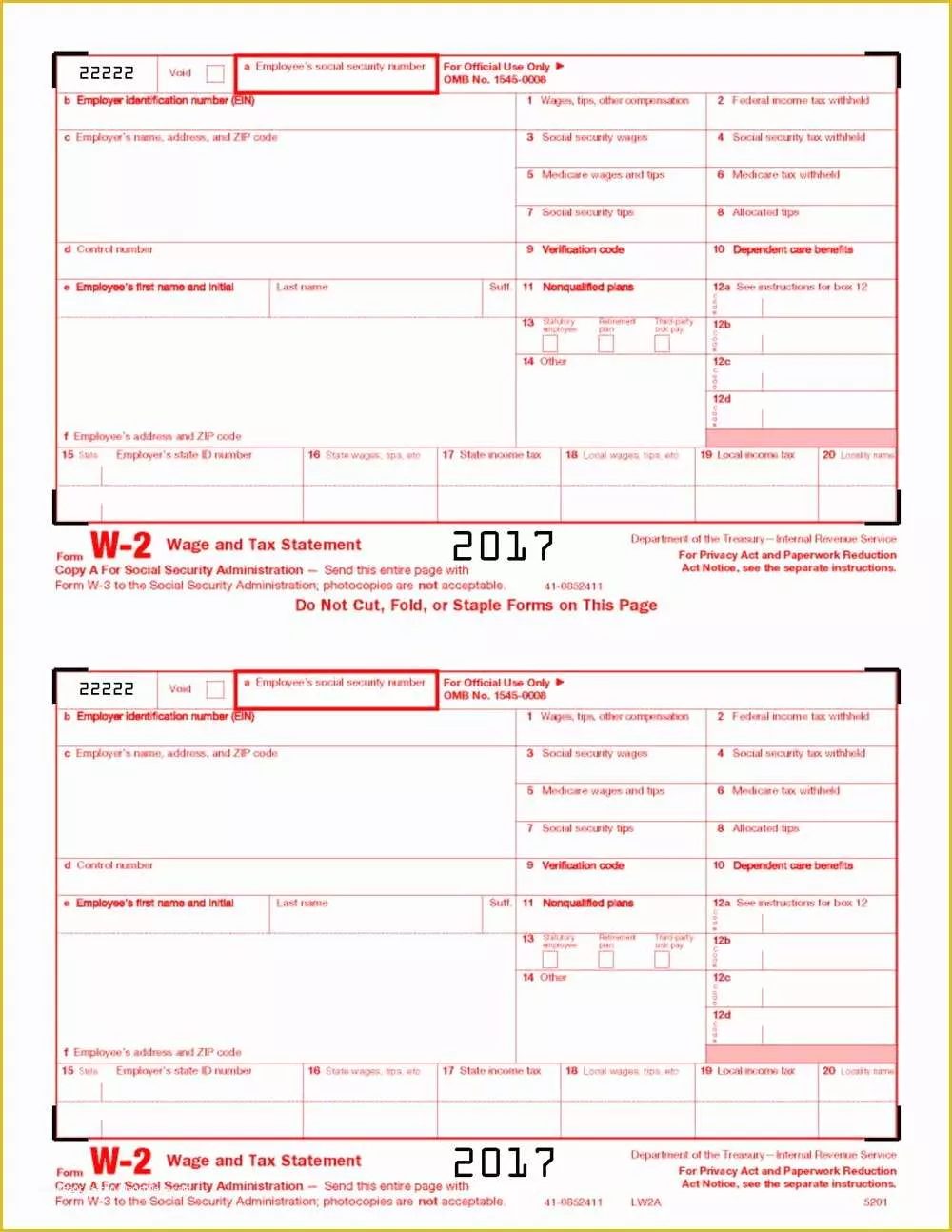

Windows 11, 10, 8.1, 9, Vista, 7, XP and other Windows computers or MAC computer installed with Virtual Machine or Parallels.Do not file a Form 941-X with a Form 941. File a separate Form 941-X for each Form 941 you are correcting.When you discover an error on a previously filed Form 941, you must:.Used on the Form 941-x, Supporting Statement to Correction Information, when applicable. Make sure you use the Employer Identification Number (EIN) issued by IRS on all Forms W-2c/W-3c. If you reported your EIN incorrectly, please file a W-3c to correct it. If any item shows a dollar amount change and one of the amounts is zero, If you believe the 250 threshold requirements will create a hardship, refer to Form 8508, Request for Waiver From Filing Information Returns Electronically, To Publication 1223, General Rules and Specifications for Substitute Forms W-2c and W-3c at. Social Security's Specifications for Filing Forms W-2 Electronically (EFW2) at. If you expect to file 250 or more W-2cs during a calendar year, you are required to file themĮlectronically with SSA. If you use your own software to prepare and submit paper Forms W-2c,įollow the instructions in Social Security's To correct a Form W-2 you have already submitted, file a Form W-2c with a separate Form W-3c for each year needing correction.įile a Form W-3c whenever you file a Form W-2c, even if you are only filing a Form W-2c to correct an employee's name or Social Security number (SSN).įollow the General Instructions for Forms W-2c/W-3c. Also, provide a Form W-2c to the employee as soon as possible. File Forms W-2c (Corrected Wage and Tax Statement) and W-3c (Transmittal of Corrected Wage and Tax Statement) as soon as possible after you discover an error.

0 kommentar(er)

0 kommentar(er)